[ad_1]

Nintendo recently announced it is shutting down Animal Crossing: Pocket Camp’s current iteration as a F2P mobile game, but it’ll be coming back as a pay-to-play title on iOS and Android. Nintendo’s historical earnings data might give some clues as to why this is happening.

VIEW GALLERY – 3 IMAGES

Animal Crossing: Pocket Camp is Nintendo’s 3rd most-popular mobile title with over 10 million downloads, so why is the company shutting it down, and re-launching it as a pay-to-play game? There’s a few possible reasons for this.

The first is that NDCube, the development studio responsible for Animal Crossing: Pocket Camp, may be too busy to actually upkeep the live game over time with new content and in-app purchases–especially via Pocket Camp’s own subscription service. After all, NDCube has been pretty busy over the past 6 years, having developed 5x Switch games including two Mario Party titles.

Online service for Animal Crossing: Pocket Camp will end on November 29th, 2024 at 12:00 AM (JST).

After service ends, you will no longer be able to play Animal Crossing: Pocket Camp.

Note that we are currently developing a paid version of the app to which you will be able to transfer your save data. It will be released during the same period as the end of service for Animal Crossing: Pocket Camp.

The second may have something to do with Nintendo’s mobile aspirations.

The company has taken a unique approach to mobile gaming, opting for free-to-start models with some games like Super Mario Run, and a total free-to-play option for games like Animal Crossing: Pocket Camp, Fire Emblem Heroes, and the newly-released Pikmin Bloom.

Taking a closer look at Nintendo’s historical mobile revenues may give us more clues on the company’s current mobile plans.

Nintendo makes most of its revenues from its dedicated Switch platform. There’s two other segments: A combination of its IP-related income (think licensing and the Super Mario movie) and mobile games, and the second segment, Nintendo’s traditional playing cards and others.

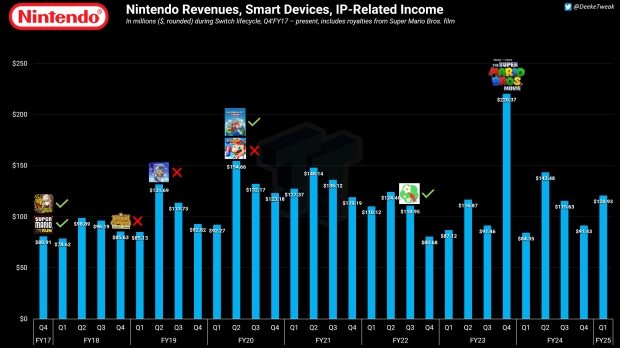

Isolating the IP-related and mobile earnings gives us an interesting look at what’s going on with Nintendo’s smartphone games.

Since Q4’17 when the Switch launched, this segment has peaked at $220 million throughout Q4’23 thanks to royalties from the Super Mario Bros. film. That’s despite the release of multiple mobile titles, many of which were on the market at the same time. The second-best period was in Q2’20 when Mario Kart Tour and Dr. Mario were both released, with the segment earning $154 million.

Note that it’s currently not possible to separate the IP-related income from the mobile earnings, so it’s harder to estimate how much of these earnings were from mobile games.

Throughout the last 30 quarters, this segment has been a guaranteed moneymaker, with revenues not dropping below $78 million across all quarters. This indicates some level of success for Nintendo, but it’s certainly not the higher-end success that Nintendo had hoped for; in 2018, CEO Shuntaro Furukawa said that mobile could be a $1 billion business for Nintendo.

While Nintendo has indeed made billions of dollars from this segment since the Switch’s launch in March 2017–approximately $3.394 billion, to be more exact–it still may not be yielding as much revenue as the company had hoped.

So the pivot towards a traditional pay-to-play model is a guaranteed form of purchasing, at least in the case of Animal Crossing: Pocket Camp, and it feels like the game is going the more traditional model and being placed outside of the microtransaction-driven economy that Nintendo had previously envisioned.

This will trade potential purchases for guaranteed purchases, which could buoy Nintendo’s mobile earnings during a possible lull period–this segment notably dropped shortly after the release of Pikmin Bloom.

[ad_2]