Elanco Animal Health (NYSE:ELAN – Get Rating) had its price target decreased by equities research analysts at JPMorgan Chase & Co. from $24.00 to $20.00 in a report issued on Monday, The Fly reports. JPMorgan Chase & Co.’s price objective points to a potential upside of 70.21% from the stock’s previous close.

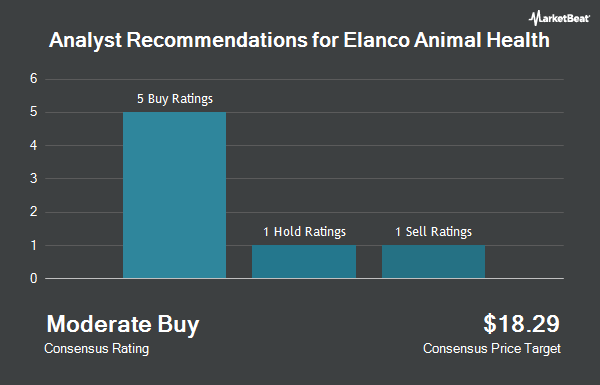

Several other research analysts also recently weighed in on the stock. Piper Sandler dropped their target price on shares of Elanco Animal Health from $22.00 to $21.00 and set a “neutral” rating for the company in a report on Tuesday, August 16th. Barclays decreased their target price on Elanco Animal Health from $32.00 to $18.00 and set an “equal weight” rating on the stock in a research note on Monday, September 12th. The Goldman Sachs Group downgraded Elanco Animal Health from a “buy” rating to a “sell” rating and dropped their price target for the stock from $32.00 to $19.00 in a research note on Thursday, July 21st. TheStreet cut shares of Elanco Animal Health from a “c-” rating to a “d+” rating in a research report on Tuesday, October 4th. Finally, Stifel Nicolaus dropped their target price on shares of Elanco Animal Health from $30.00 to $22.00 and set a “hold” rating for the company in a research report on Friday, June 24th. One equities research analyst has rated the stock with a sell rating and five have issued a hold rating to the company’s stock. According to data from MarketBeat.com, the stock currently has a consensus rating of “Hold” and an average price target of $20.17.

Elanco Animal Health Stock Performance

NYSE:ELAN opened at $11.75 on Monday. The company has a debt-to-equity ratio of 0.84, a quick ratio of 1.47 and a current ratio of 2.47. The stock has a 50-day simple moving average of $15.05 and a two-hundred day simple moving average of $20.01. The firm has a market capitalization of $5.57 billion, a PE ratio of -33.57, a P/E/G ratio of 1.19 and a beta of 0.92. Elanco Animal Health has a 52-week low of $11.34 and a 52-week high of $35.00.

Elanco Animal Health (NYSE:ELAN – Get Rating) last announced its quarterly earnings data on Monday, August 8th. The company reported $0.36 earnings per share (EPS) for the quarter, beating analysts’ consensus estimates of $0.26 by $0.10. Elanco Animal Health had a positive return on equity of 7.40% and a negative net margin of 3.77%. The company had revenue of $1.18 billion during the quarter, compared to the consensus estimate of $1.18 billion. During the same period in the previous year, the company posted $0.28 EPS. The firm’s revenue was down 8.0% on a year-over-year basis. Analysts forecast that Elanco Animal Health will post 1.09 EPS for the current year.

Insider Buying and Selling

In other Elanco Animal Health news, CEO Jeffrey N. Simmons bought 30,000 shares of the firm’s stock in a transaction dated Friday, September 9th. The shares were purchased at an average cost of $14.54 per share, for a total transaction of $436,200.00. Following the transaction, the chief executive officer now owns 30,000 shares of the company’s stock, valued at $436,200. The transaction was disclosed in a legal filing with the SEC, which is available through this link. In related news, CEO Jeffrey N. Simmons acquired 30,000 shares of the firm’s stock in a transaction on Friday, September 9th. The shares were acquired at an average cost of $14.54 per share, for a total transaction of $436,200.00. Following the completion of the transaction, the chief executive officer now directly owns 30,000 shares in the company, valued at approximately $436,200. The transaction was disclosed in a filing with the SEC, which can be accessed through this hyperlink. Also, Director R David Hoover bought 20,000 shares of the company’s stock in a transaction dated Friday, September 9th. The stock was bought at an average price of $15.18 per share, with a total value of $303,600.00. Following the acquisition, the director now owns 145,000 shares in the company, valued at approximately $2,201,100. The disclosure for this purchase can be found here. Over the last 90 days, insiders have acquired 56,700 shares of company stock worth $839,630. Insiders own 6.40% of the company’s stock.

Institutional Inflows and Outflows

Large investors have recently modified their holdings of the business. Telemus Capital LLC grew its position in Elanco Animal Health by 5.2% in the 1st quarter. Telemus Capital LLC now owns 39,505 shares of the company’s stock valued at $1,031,000 after acquiring an additional 1,951 shares during the last quarter. First Hawaiian Bank increased its stake in Elanco Animal Health by 16.0% in the 1st quarter. First Hawaiian Bank now owns 36,800 shares of the company’s stock worth $960,000 after buying an additional 5,067 shares during the period. DNB Asset Management AS lifted its holdings in Elanco Animal Health by 9.2% during the 1st quarter. DNB Asset Management AS now owns 61,971 shares of the company’s stock valued at $1,617,000 after buying an additional 5,203 shares in the last quarter. Keene & Associates Inc. boosted its position in Elanco Animal Health by 16.4% in the 1st quarter. Keene & Associates Inc. now owns 24,040 shares of the company’s stock valued at $627,000 after buying an additional 3,395 shares during the period. Finally, Redpoint Investment Management Pty Ltd grew its stake in Elanco Animal Health by 37.4% in the 1st quarter. Redpoint Investment Management Pty Ltd now owns 9,706 shares of the company’s stock worth $253,000 after acquiring an additional 2,640 shares in the last quarter. Hedge funds and other institutional investors own 98.15% of the company’s stock.

Elanco Animal Health Company Profile

(Get Rating)

Elanco Animal Health Incorporated, an animal health company, innovates, develops, manufactures, and markets products for pets and farm animals. It offers pet health disease prevention products, such as parasiticide and vaccine products that protect pets from worms, fleas, and ticks under the Seresto, Advantage, Advantix, and Advocate brands; pet health therapeutics for pain, osteoarthritis, ear infections, cardiovascular, and dermatology indications in canines and felines under the Galliprant and Claro brands; vaccines, antibiotics, parasiticides, and other products for use in poultry and aquaculture production, as well as nutritional health products, including enzymes, probiotics, and prebiotics; and a range of vaccines, antibiotics, implants, parasiticides, and other products used in ruminant and swine production under the Rumensin and Baytril brands.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Elanco Animal Health, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Elanco Animal Health wasn’t on the list.

While Elanco Animal Health currently has a “Hold” rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here